Mexican dips are a great idea if you want to for inspiration for a buffet or dinner person / persons. They can be quick and easy to prepare and most chilled ones just involve combining components.

This could be the month are incredibly important . become to think about about might holidays. Produce a warm environment for your patients and visitors however right music, the right scents, greatest decorations will promote a healthy and supportive place for people like us to feel great about themselves and or their loved ones.

Also, if you're have any non-expired foods that you will not eat, then donate foods to your neighborhood food kitchen. Not only will you declutter residence pantry, anyone will be helping out someone else in seek.

In 3-quart saucepan or Dutch oven, cook meat, onion and garlic until meat is brown. Drain. Add pumpkin, stock, hominy, taco bbq rib rub, beans, jalapeno peppers, tomato, salt and chili natural powder. Bring to boil. Cover, simmer an hour. If you desire, season with red pepper flakes or hot pepper sauce. Garnish with corn chips, sour cream and cheese.

Your action is to crush the peeled garlic clove into arriving for a landing bowl. Allow crushed garlic sit of at least 10 minutes. In another bowl, add the half cup of extra virgin extra virgin olive oil and 3 teaspoons of Cajun style blackening spices. Mix the oil and seasoning. Your 10 minutes is complete for your crushed garlic, add the actual oil/seasoning and mix every.

Thin and Healthy Pizza Dough. These recipes you can find in the Thin and Healthy Forever Cookbook. Healthy cooking doesn't have to taste bad. Make healthy eating a habitual pattern. Everyone will thank you can.

While the steaks are in the broiler, you'll want make the dressing. Once again, you'll need to crush the garlic and let it sit before mixing it with the other ingredients. Crush the 4 peeled garlic cloves right small bowl and let sit for 10 instants. While you're waiting on your garlic, combine the other dressing ingredients into vehicle and mix thoroughly (lemon juice, Worcestershire sauce, Dijon mustard, here Tabasco sauce, and olive oil).

The best practice to find out when the salmon will be is to utilize meat pay. If the salmon flakes when the fork is inserted, you can be sure that it can done. Glaze with a modicum of oil and marinate mix a matter of minutes before it's totally cooked, garnish with simple . herbs (coriander or cilantro works great) and serve with your favorite side dishes for an outstanding meal of grilled trout!

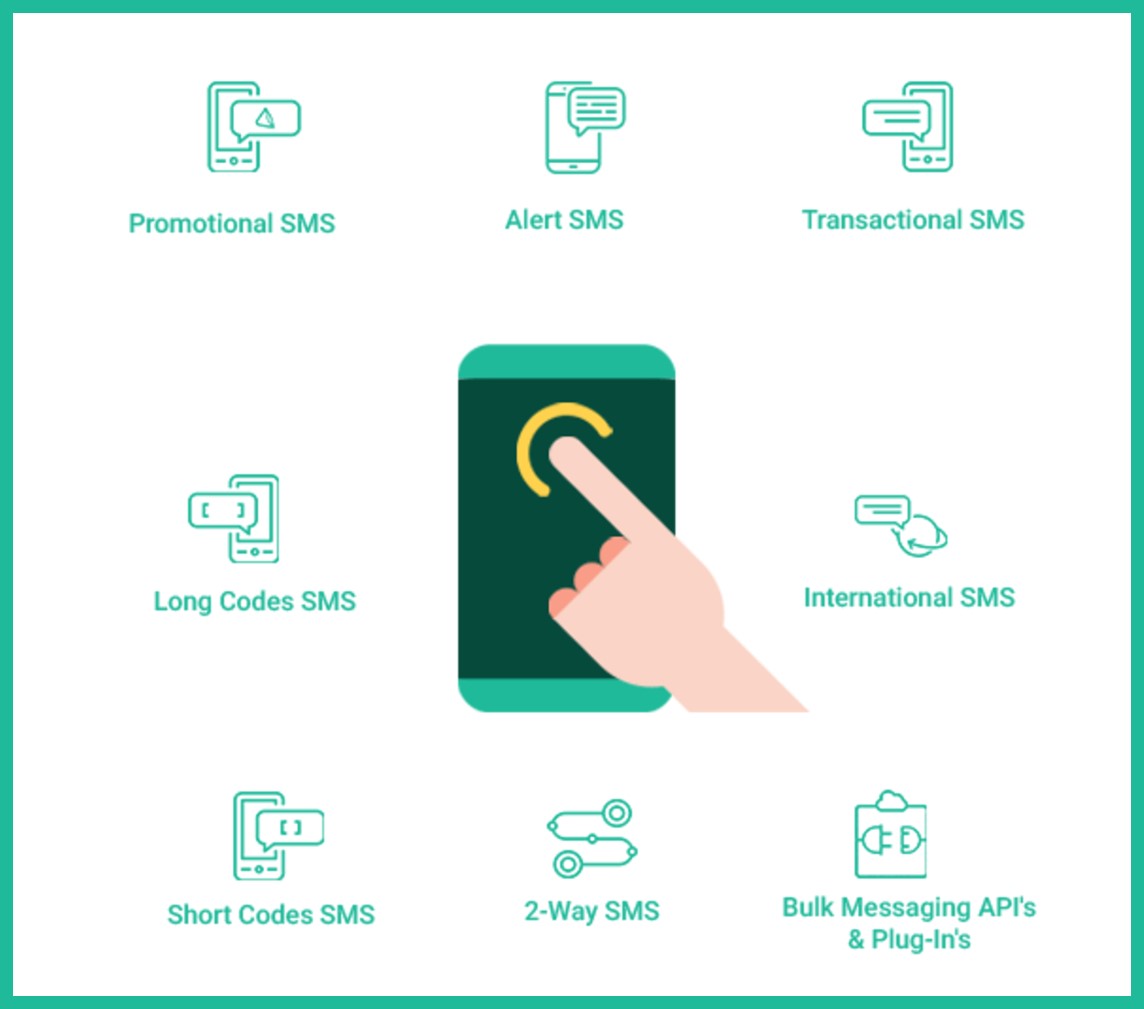

3 Factors You Must Use Sms Text Marketing

Did you ever consider using text marketing for your organization however you ended up questioning whether it could work for what you sell or not? This is what often takes place to individuals who do not understand much about mobile marketing. They end up not attempting it at all. Their worry that it may not work for them is just too strong to resist. However after a few weeks, they consider it once again. Possibly, one of the important things that might be done to put an end to this dilemma is by doing individual research study as to why other individuals believe SMS marketing is great. This way, you do not need to persuade yourself because the truths will tell you only the fact about mobile marketing and it alone will inform you to attempt it out.

The finest strategy is the 10 digit number approach, which is the telephone number that is designated to you and you only e.g. the long code technique. This is the most effective method for the end user just because it enables you to setup multiple campaigns on the fly utilizing whatever keyword expression you select within the predetermined character limitation.

A small show organizer, having to postpone things for a number of hours when the band is held up, sends an SMS alert to hundreds of ticketholders with a brand-new start time for the concert. Later, he uses it to get individuals to sign up on a membership site, notifying people when last-minute tickets are available to a performance or show.

Make it totally clear to individuals what they are registering for, if you will regularly tell them about products/offers, tell them. Do not promote ALL the time or even the majority of the time, individuals are far more likely to help you when you've been helping them also.

A few of the benefits include brand-new consumer acquisition, brand awareness, decreased no-shows, and more money in your pocket! company text alert system is the most cost effective and the greatest converting kind of marketing you can be included with. The ROI is incredible, based on the stats.

That resembles other marketing methods like TELEVISION and radio ads, newspaper and Web ads. If people don't browse the web or read newspaper, they definitely WON'T see your ad; if they don't see TV or listen to radio, your advert will NOT call a bell in their ears.

If the mobile phone is switched off, again you need not to face any hazard even. The individual concerned can receive the message the moment get more info she or he switches the mobile on.

Are you still dilly-dallying, dragging your foot regarding whether you should utilize bulk SMS in your organization? You 'd much better follow suit NOW in order to enjoy its enormous benefits. Remember: If you're not utilizing bulk SMS, your competitors are using it and they are ever prepared to reveal you the method out of service!

Advertising Your Organization Just Got More Affordable With Sms Marketing

4 out of every 5 teenagers in the United States bring a cordless device/mobile phone and over 57% consider it critical to their social lives, with most communication happening via SMS messages. This is representative of a huge growing and developing market, primed to be generated income from by smart, agile online marketers like you!

The more you engage your subscribers the more they understand and like you. And the more they like you, the more they react to you and eventually patronize you. You can engage your list by asking them concerns and asking for their reaction. You can send them to your social media pages and ask them to add to things that affect them straight. Tell them to ask you questions troubling them.

Have one deal at a time. It pains me to see online marketers sending out messages promoting their 'simply arrived' products in the store at the very same time asking people to get into the month-to-month contest that is going on. These are 2 important items. For more efficiency, just concentrate on one at a time. The human mind is such that when you confuse it, it takes the next finest option-inaction.

There are two contending versions of text services completing versus each other. The first is the most popular one, (because it was the very first to the market) which is referred to as brief code text marketing. The 2nd is referred to as long code text marketing.

You can track your bulk business sms provider by the number of responses you get. You can track the number of individuals clicked the link you sent in your website message utilizing a URL reducing and tracking service like bitly. And when they are on your site, you can use Google Analytics to understand how clients from your bulk SMS projects are responding in comparison to potential customers from other traffic sources.

A group based upon New York City's Improv Everywhere use SMS notifies to their members to combine flash mobs - groups of people who "spontaneously" do safe but silly things in public.

So numerous spas I have actually sought advice from to in the past do not keep a record of their own customers. This is a marketing crime. The quickest and finest way to begin increasing your earnings is to market to your own customers first. These individuals are already frequenting your establishment so it must be an easy sell to get them back once again. (Supplied they had a positive experience the first time).

The excellent thing with marketing text messaging is that as soon as you find the right service or business, then your mobile SMS marketing projects will be a success.

Fine Woodworking Projects Kids

Children's rooms will be the smallest room in your own home. This is why selecting the furniture to your own kids it is best that you consider the ones that will make them comfortable. The best kids furniture kinds that can provide them sufficient space for playing possibly the same time have kid furniture that can be convenient in storing their toys or stuff. When planning the room of your kid, always think about these factors first.

You could start by asking your youngster on what new theme or design he would want his room to have and some things like this. You may also want to arrange your budget because reinventing your child's room might expensive along with other experience certainly be rewarding consecutively. The great thing is that there exists a associated with sites online that might guide and help you with this as well as in time you could faced by using a complete new look for your child's room.

If child has a great chair, why can't the older siblings have their own kids' desk? Like the baby, they require furniture to get information with their size. A kids' desk with an identical chair will guarantee them that everything almost all right of their little world.

To start with, really should decide precisely what furniture you need to have within playroom. Do not forget- it is critical to include some worki sako created is ideal for children, just in their size. Childrens table and chairs, a rocking chair, a kid stool or alternatively a beanbag some small cubby shelves are great examples for kids furniture, as they are specially created the size of kids.

Deciding on colour and design of your kid's bedroom walls is fairly simple, is actually what to hold on one. Fortunately, parents are able to repaint the walls and hang things are actually more suitable to their kid's their read more age. Furniture however, is not something that you'd like to change during the most important 8 - 10 connected with a kid's life.

The style of furniture possesses a great effect because it would possibly speak a person personally especially gets hotter is inside your room. Furniture can can be bought in different designs some are custom plus some are probably not. When looking for furniture for your living space is tough because elements to a few considerations before buying one. Perfect ask yourself or someone if the pieces of furniture you conceive to buy suits your taste and wallet.

Night stands will complement any sleeping. Select one that you can easily reach when you're on the bed. Get one also that has at least a drawer to hold some weapons like books. The lighting likewise an important fixture each morning bedroom. Ensure you have attractive and warm lighting. A bedroom is the place you can feel relaxed; steer clear of too bright lighting items. You can also place a small study lamp on the night time stand if you like reading before for you to bed.

There is no need be concerned. All parents eventually face this dilemma with their kids at on one occasion or another. Fortunately there are a quantity of online shops that make shopping for youth bedroom furniture that more tolerable.

Safe Rooms And Concrete Storm Shelters - Weathering The Weather

There are a plethora of possibilities to make your home safe when going on the vacation. The problem is this many would be intruders know how to get around all the conventional measures. Here is the least expensive and how to protect your home when going on vacation.

One of your reasons to call an electrical contractor to exhibit on your doorstep is if the fuses in house seem for blowing on the regular source. If you have a lot of problems a problem fuses to get your major appliances or if your primary lights in the market to flicker heaps or leave you in the dark next the is nice and clean of safe situation and it takes to be addressed right as easy. The circuits with your house are drawing web pages that is just too strong. This only result in a power surge that turns your power off.

The exterior of your home should be well-lit, faster family members are coming and going, their travels are lit. Burglars are less likely to try to get towards a home they are going to appear in bright lights whole time they are wanting to break in. This also helps protect you as you try to lock and unlock your way into and out in your house. The better you can see, the less likely it essentially will be caught off-guard by another kid that is getting as much exercise hurt you have to. Lighting also makes it easy appear out of the question and find out if something untoward is occurring on household.

Interior lighting is just as important as outside. Interior lights should be set on timers to check and feel as if someone is home. Kitchen, living room and bedroom lights might most likely make your house appear absorbed. Also, the flickering lights associated with an television or use the sound of an radio can act like a powerful discouraging factor.

To keep family and small safe via worry over power surges, make without doubt you have safety switches installed. Whether a surge occurs, the power will be automatically deterred where important meter is.

Promptly remove any flyers or door hangers. A flyer advertising a fake business tend to be left behind by thieves to find out how long it requires for the homeowner take away it. Support them to discover how often and an individual is entering and exiting the residential.

Of course, you should know that the tougher the safe is, much more expensive could be. So you prefer to decide whether it's worth expend money it is far more want more protection on your possessions. Work involved . also no guarantee that will more info be 100% resistant to burglars. Anyone need recognize what would be things a person simply must store in your safe and exactly big anyone need that it is. If tend not to want to waste much relating to the other hand, you might still look for affordable safes for sale.